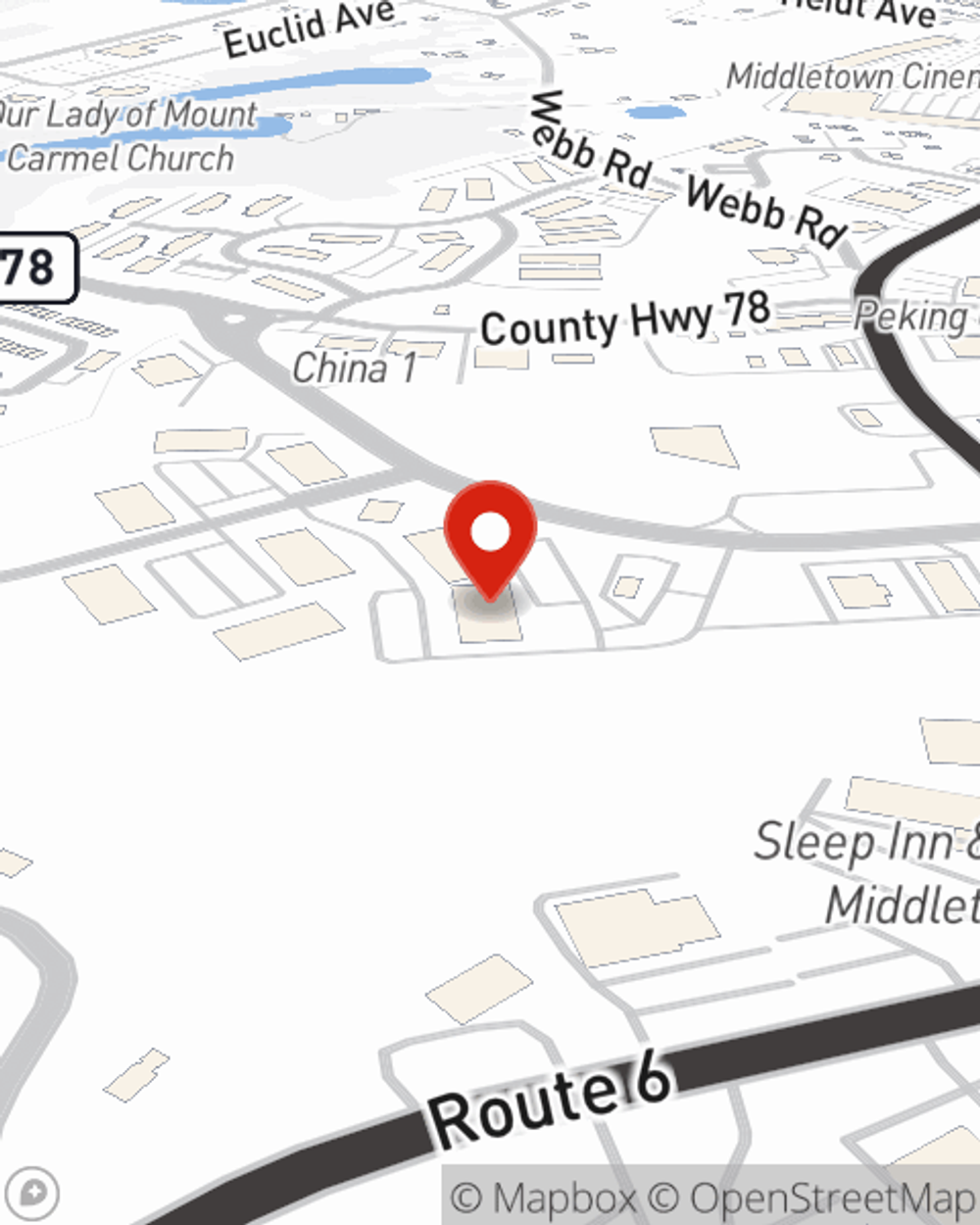

Business Insurance in and around Middletown

One of the top small business insurance companies in Middletown, and beyond.

Insure your business, intentionally

This Coverage Is Worth It.

Preparation is key for when a mishap happens on your business's property like a customer hurting themselves.

One of the top small business insurance companies in Middletown, and beyond.

Insure your business, intentionally

Small Business Insurance You Can Count On

Protecting your business from these potential mishaps is as easy as choosing State Farm. With this small business insurance, agent James Demmer can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

So, take the responsible next step for your business and contact State Farm agent James Demmer to discover your small business insurance options!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

James Demmer

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.